Market Selloff & Tech Slump — S&P 500 Drops 1.5% on Recession Fears, Tesla Erases 91% Election Rally, AppLovin Faces Pressure but Citi Stays Bullish

Happy Monday, everyone! 🎉 I’m excited to share that our team has upgraded the Analytics Dashboard! The enhanced dashboard now provides a powerful high-level view of market trends and key AI events, helping you stay ahead of the game. Check it out if you haven’t already!

By clicking on the ads, you’re directly supporting us to keep delivering quality content and insights, while also helping us earn revenue to continue our work. Every click makes a difference—thank you for your support!

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

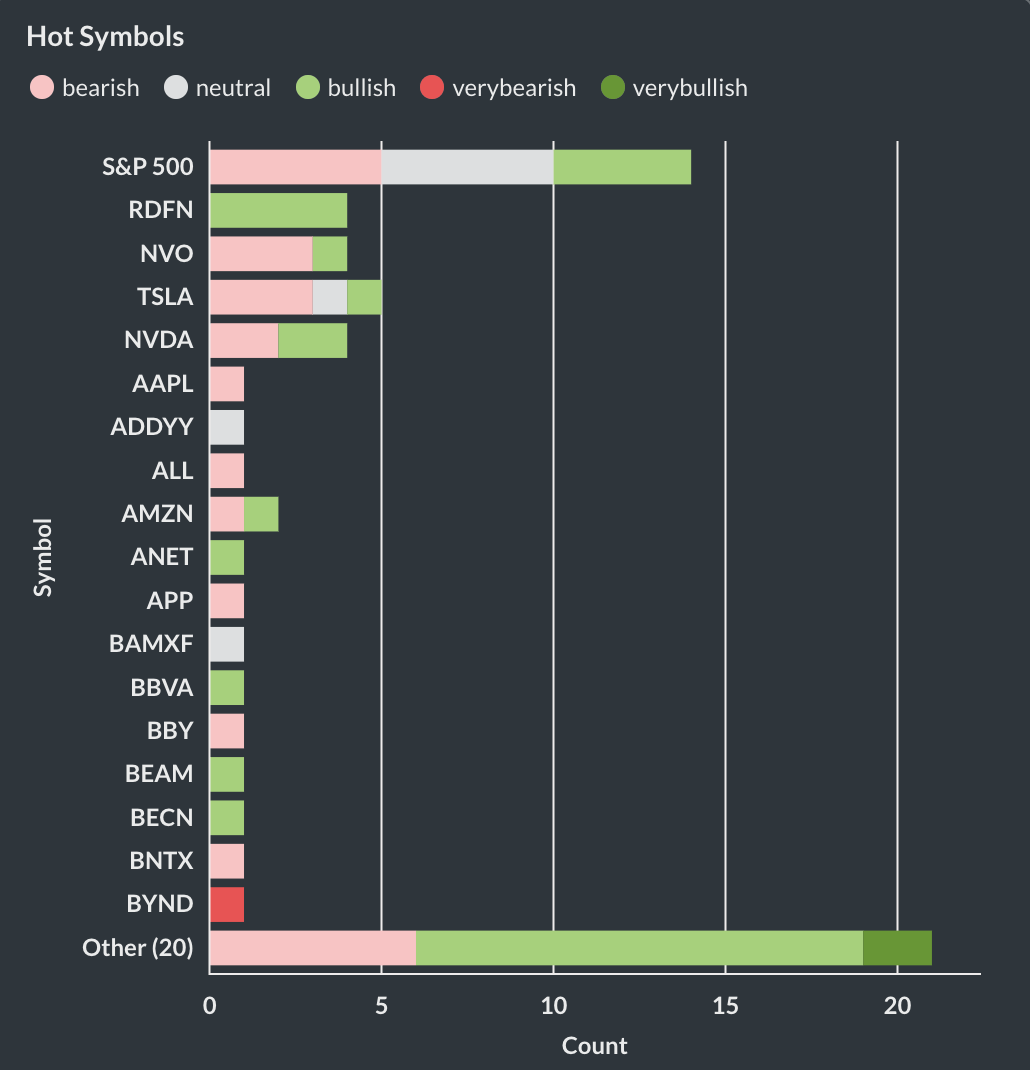

Here’re the stocks with notable attention/movement for today, 3/10.

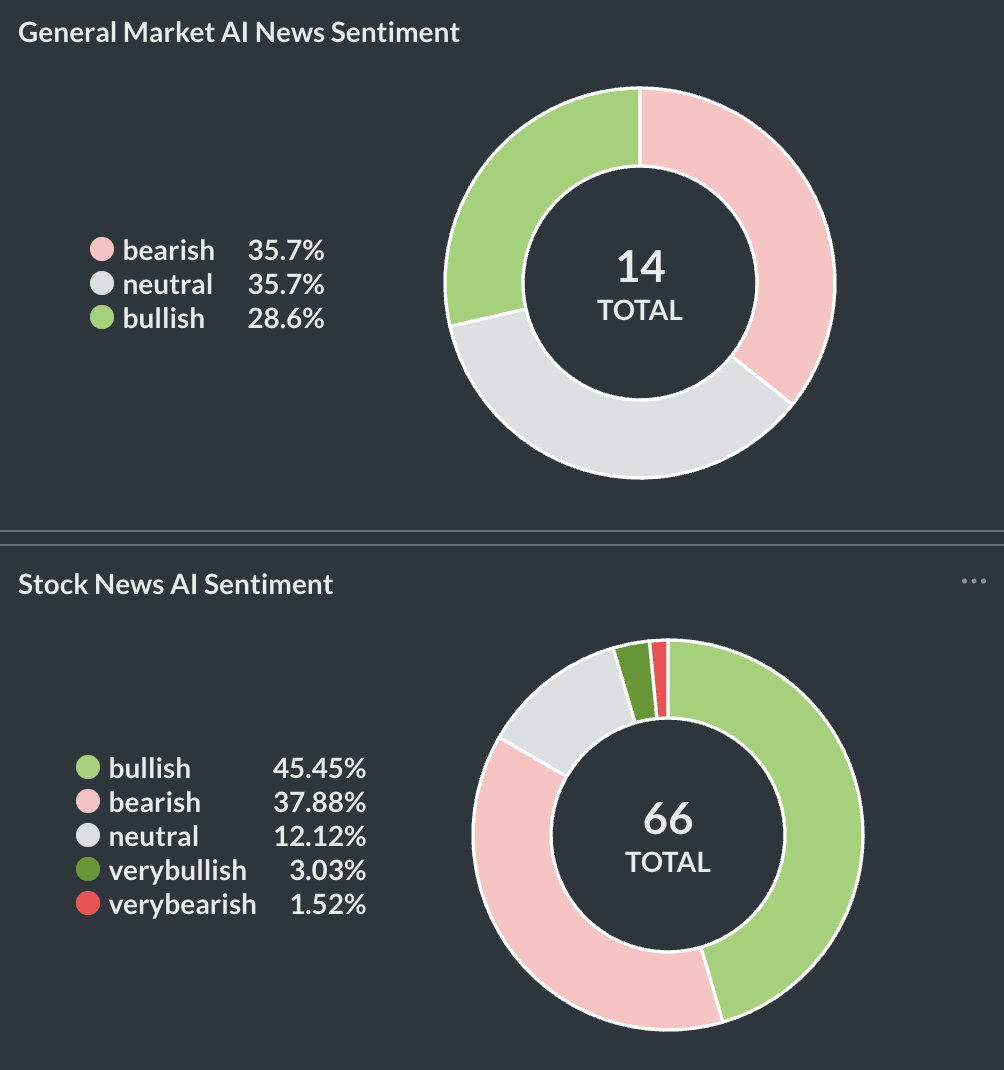

Overall, our AI shows a bearish stance on general market news but a slightly more bullish outlook on today’s AI-related events.

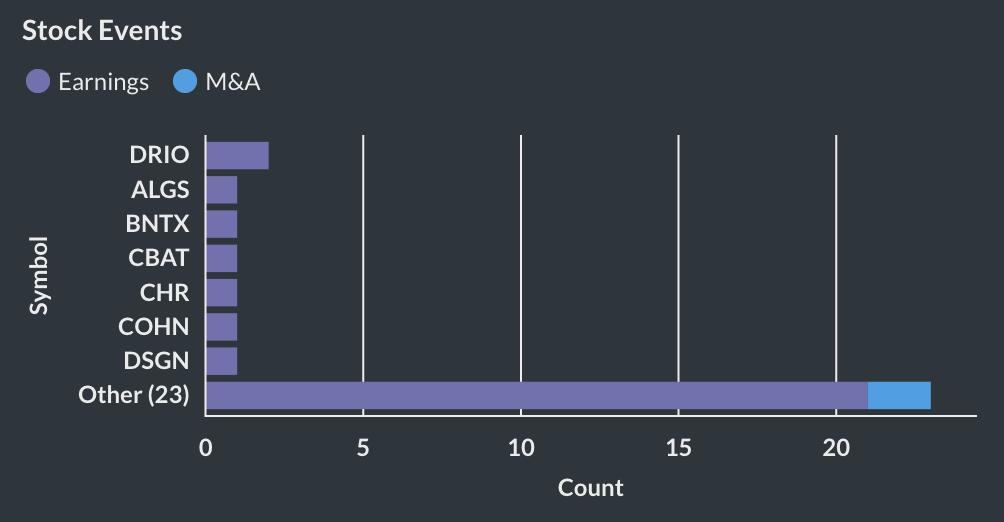

Here’s a breakdown of key stock events by our AI Event signal for today, 3/10.

Top 3 Must-Know News Stories for Today, 3/10.

Our AI cuts through the noise, saving you 13 minutes by delivering the heart of today’s events in seconds!

Forbes

BearishShortTermS&P 500Economics

Stock Market Comeback Erased: Dow Sinks As Trump Says Don't ‘Watch The Stock Market'

- S&P 500 declined 1.5% amid fears of recession.

- Trump's tariff policies are causing market uncertainty.

- Goldman Sachs raised recession odds to 20% within 12 months.

- Major tech stocks, like Nvidia and Tesla, suffered significant losses.

- Morgan Stanley maintains a bullish long-term outlook for S&P 500.

Barrons

BearishShortTermAPPIndustry News

AppLovin Stock Is ‘Under Significant Pressure.’ This Analyst is Upbeat. - Barron's

- AppLovin shares dropped 8.66% amid bearish market sentiment.

- Analyst Jason Bazinet projects potential gains for APP in 2025.

- Short sellers raised concerns about AppLovin's ad compliance practices.

- Despite downturn, APP gained nearly 351% annually, showing resilience.

- Citi maintains a Buy rating with a target price of $600.

Forbes

BearishShortTermTSLAIndustry News

Tesla Stock's Election Rally Is All Gone—Erasing 91% Gain

- Tesla shares fell 8% to $241, lowest since November 2020.

- Analyst forecasts expect a 5% decline in Tesla's 2025 vehicle deliveries.

- Analyst forecasts expect a 5% decline in Tesla's 2025 vehicle deliveries.

- Market concerns are linked to Trump's economic policies affecting tech stocks.

- Musk's net worth has dropped $134 billion due to falling Tesla shares.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply