In partnership with

Trump Tariffs Roil Markets — Steel Stocks Rise, While German American Expands via $8.3B Heartland Merger and EMCOR Grows with $865M Miller Electric Acquisition.

By clicking on the ads, you’re directly supporting us to keep delivering quality content and insights, while also helping us earn revenue to continue our work. Every click makes a difference—thank you for your support!

The future of moving starts here.

Where you live shapes how you live. We make moving simpler, clearer, and better with tools that guide you from exploring new places to settling in.

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

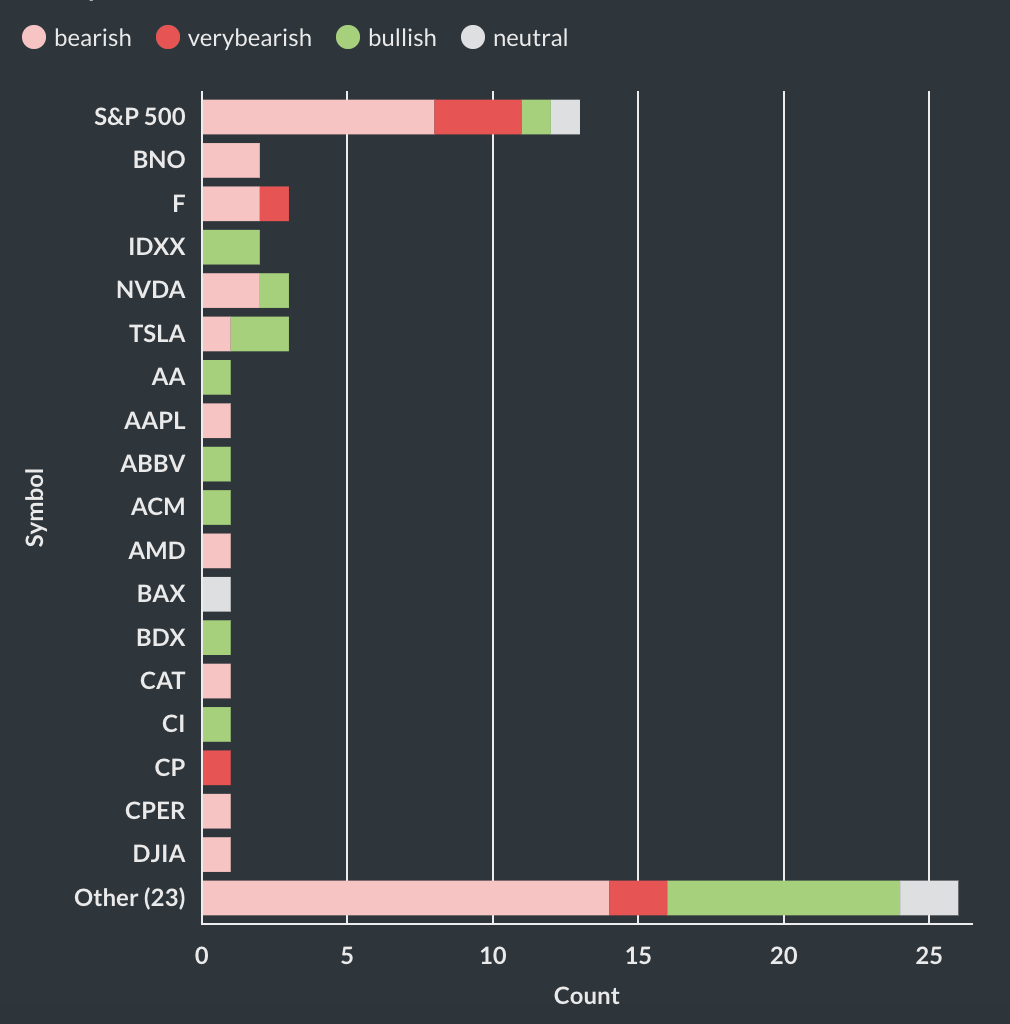

Here’re the stocks with notable attention/movement for today, 2/3.

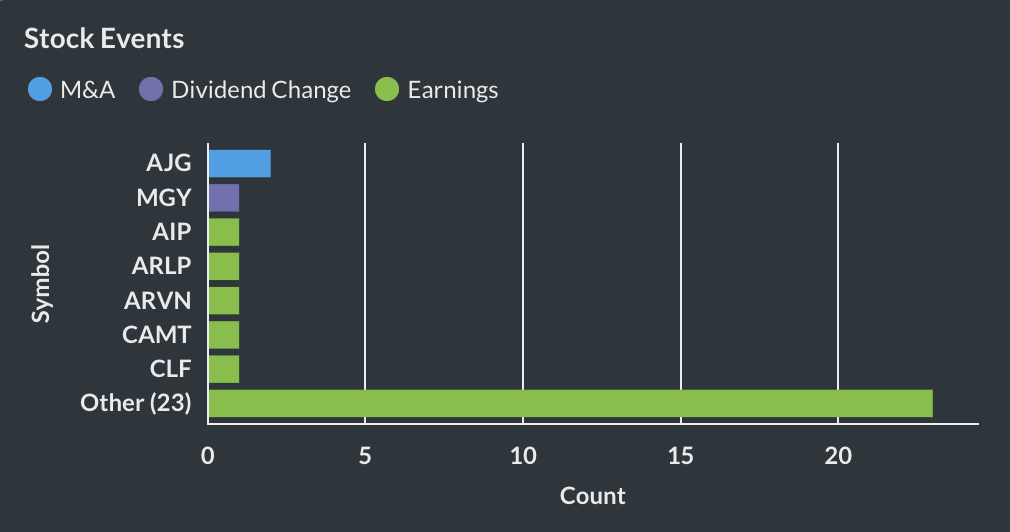

Here’s a breakdown of key stock events by our AI Event signal for today, 2/3.

Top 3 Must-Know News Stories for Today, 2/3.

Our AI cuts through the noise, saving you 22 minutes by delivering the heart of today’s events in seconds!

New York Post

VeryBearlishShortTermS&P 500Economics

Wall Street in tailspin as Trump tariffs on Canada, Mexico and China take effect

- Trump's tariffs on China, Canada, Mexico sparked a market drop.

- S&P 500 fell 1.6%, Dow decreased 560 points due to tariff concerns.

- Companies with supply chains in North America particularly affected.

- Volatility index spiked, indicating increased market anxiety.

- Steel manufacturers benefitted from tariff announcements, reflecting market shifts.

Business Wire

BullishLongTermGABCM&A

German American Announces Completion of Merger With Heartland BancCorp and Heartland Bank

- German American Bancorp completed its merger with Heartland BancCorp today.

- Heartland shareholders receive 3.90 shares of GABC for each Heartland share.

- The merger expands GABC's footprint in fast-growing Ohio markets.

- Combined assets reach approximately $8.3 billion, enhancing GABC's market position.

- CEO anticipates increased earnings per share and capital strength post-merger.

Business Wire

BullishLongTermEMEM&A

EMCOR Group, Inc. Completes Acquisition of Miller Electric Company

- EMCOR acquired Miller Electric for $865 million to expand in high growth sectors.

- Miller Electric expected to generate $805 million revenue and $80 million EBITDA in 2024.

- Transaction to slightly boost EMCOR’s earnings per share in 2025 and beyond.

- Miller Electric will operate within EMCOR’s Electrical Construction Services segment.

- The deal funded via cash on hand, emphasizing economic stability.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply