In partnership with

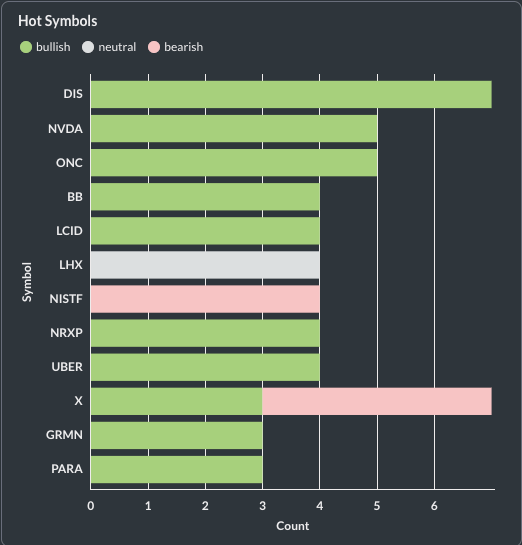

Bullish Trend Led by DIS, UBER & NVDA — Disney-Fubo Merger Boosts Streaming; Uber Buyback Fuels Optimism; Nvidia Rides AI Server Demand Surge

From Wall Street to Your Portfolio: Master Value Investing

Program benefits also include:

Guest Speaker Series with top industry professionals

Exclusive access to networking and recruitment events

Invitation-Only LinkedIn Groups and Slack Channels

Certificate issued by Wharton Online and Wall Street Prep

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

Here’re the stocks with notable attention/movement for today, 1/6.

*Data captured as of 11:00 AM EST.

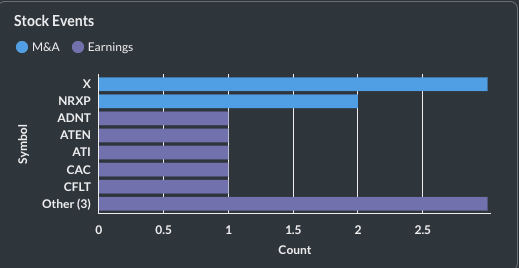

Here’s a breakdown of key stock events for today, 1/6.

*Data captured as of 11:00 AM EST.

Top 3 news you can’t miss for today, 1/6.

*Data captured as of 11:00 AM EST.

New York Post

BullishLongTermDISCorporate Developments

Disney inks deal to combine Hulu + Live TV business into Fubo

- Disney merges Hulu + Live TV with FuboTV, enhancing sports streaming prospects.

- Deal creates second-largest internet pay-TV provider in North America with $6B revenue.

- Disney retains a 70% stake, positioning for greater flexibility in streaming offerings.

- Legal battle with Fubo ends, clearing path for Disney's sports streaming service Venu.

- Fubo shares surged after the merger announcement, impacting investor sentiment positively.

Investopedia

BullishShortTermUBERCorporate Developments

Uber Stock Rises on Accelerated $1.5 Billion Buyback Plan

- Uber initiates a $1.5 billion accelerated stock buyback program.

- The buyback is part of a $7 billion total plan announced in February 2024.

- CFO claims Uber stock is undervalued and shows considerable business momentum.

- Retiring over 1% of market cap indicates confidence in stock value.

- Uber shares rose over 2.75% following the announcement, indicating positive market response.

benzinga.com

BullishLongTermNVDAIndustry News

Apple Supplier Foxconn Posts Record Revenue, Rides High On AI Server Demand And Nvidia Partnership - NVIDIA (NASDAQ:NVDA)

- Foxconn posted record revenues driven by AI server demand.

- Fourth-quarter revenue rose 15.17% year-on-year to $64.83 billion.

- Foxconn suppliers GB200 chips crucial for Nvidia's AI infrastructure.

- A new production facility for AI servers is being built in Mexico.

- High demand for Nvidia's Blackwell platform aligns with market growth.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply