In partnership with

AT&T Ends 2024 with Gains in 5G and Fiber Growth but Sees Free Cash Flow Drop; SoFi Reports $734M Revenue, $332M Profit; Sierra Bancorp Posts $10.4M Profit, 12% Loan Growth

By clicking on the ads, you’re directly supporting us to keep delivering quality content and insights, while also helping us earn revenue to continue our work. Every click makes a difference—thank you for your support!

Overseas talent with U.S. caliber resumes

Use Oceans to hire full-time finance talent and save over $100,000 a year.

✔ Deliver accurate forecasting and data-driven insights

✔ Build financial models to guide smarter decisions

✔ Help optimize profitability and cash flow

At Oceans, you get top-tier talent for just $36,000 a year.

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

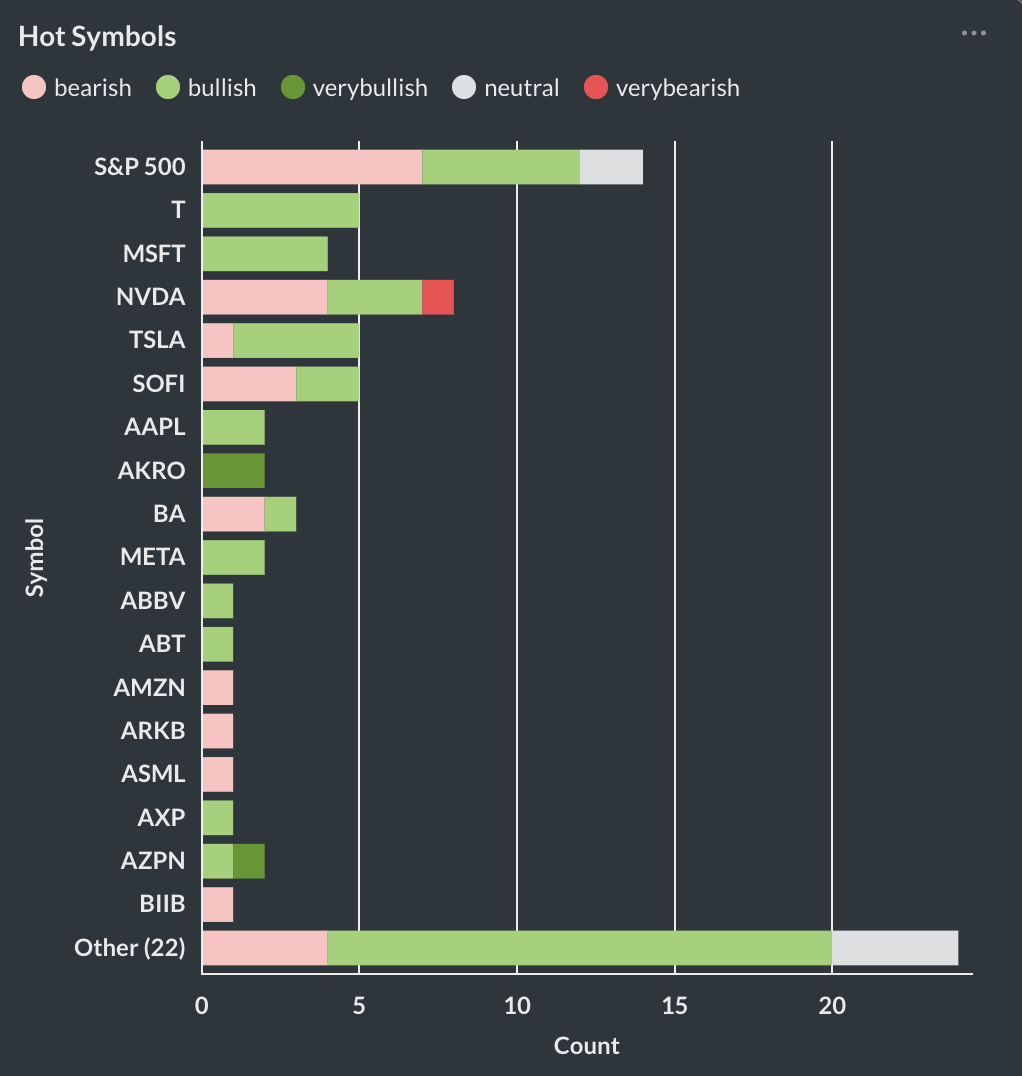

Here’re the stocks with notable attention/movement for today, 1/27.

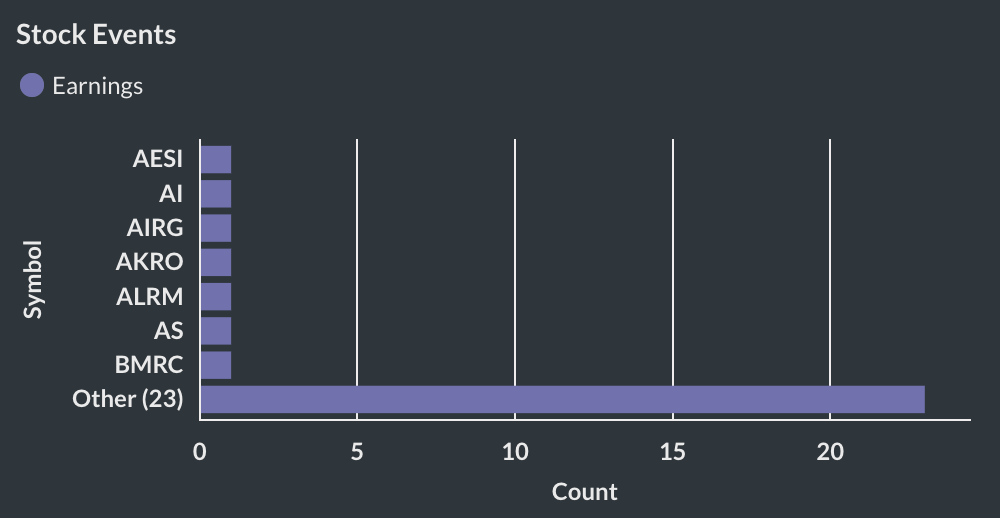

Here’s a breakdown of key stock events by our AI Event signal for today, 1/27.

Top 3 Must-Know News Stories for Today, 1/27.

Our AI delivers the heart of today’s events, which saves you 288 minutes to read today’s earning reports!

PRNewsWire

BullishLongTermTEarnings

AT&T Finishes 2024 Strong, Delivering Growth in 5G and Fiber Subscribers, Service Revenues, Cash from Operations and Free Cash Flow

- AT&T met 2024 guidance and reiterated 2025 projections.

- 482k postpaid phone net adds and low churn rate at 0.85%.

- 2024 revenue slightly down compared to 2023, with strong consumer fiber growth.

- Free cash flow of $4.8 billion, down from $6.4 billion last year.

- Plans to close DIRECTV sale mid-2025, influencing future financials.

Business Wire

VeryBullishLongTermSOFIEarnings

SoFi Technologies Reports Net Revenue of $734 Million and Net Income of $332 Million for Q4 2024, Demonstrating Durable Growth and Strong Returns

- SOFI reported strong 2024 performance; records in revenue and profit.

- GAAP net income rose to $332.5 million; Earnings per share at $0.29.

- Adjusted net revenue increased 24%; driven by a shift to higher margin segments.

- Record member growth of 785k in Q4; total members over 10 million.

- Fee-based revenue surged 63% year-over-year, highlighting strong engagement.

Business Wire

VeryBullishLongTermBSRREarnings

Sierra Bancorp Reports Year End 2024 Results and Quarterly Earnings

- Sierra Bancorp's Q4 2024 net income rose to $10.4 million.

- Return on average assets increased to 1.13%, up from 0.67% in 2023.

- Loan growth of 12% year-over-year bolsters $2.3 billion in total loans.

- Efficiency ratio improved to 59.7%, down from 67.1% in the previous year.

- Bank continues growth with increased mortgage warehouse utilization, 60% new customers.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply