The First Labor’s Day Under Trump 2.0 - The Fed Clash Sparks Global Warnings; U.S. Eyes Nuclear Restart; Alibaba Soars on AI and E-Commerce Boom

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

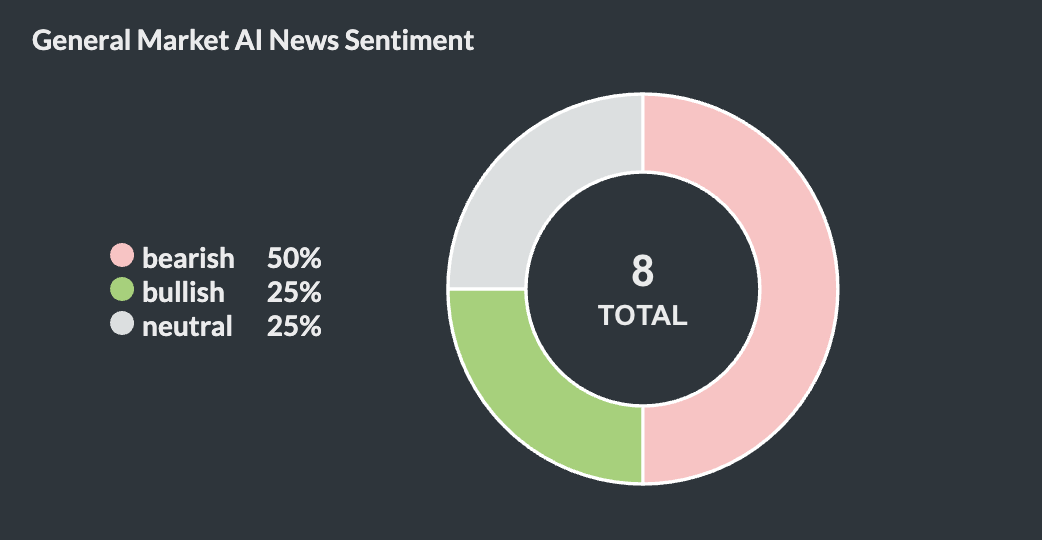

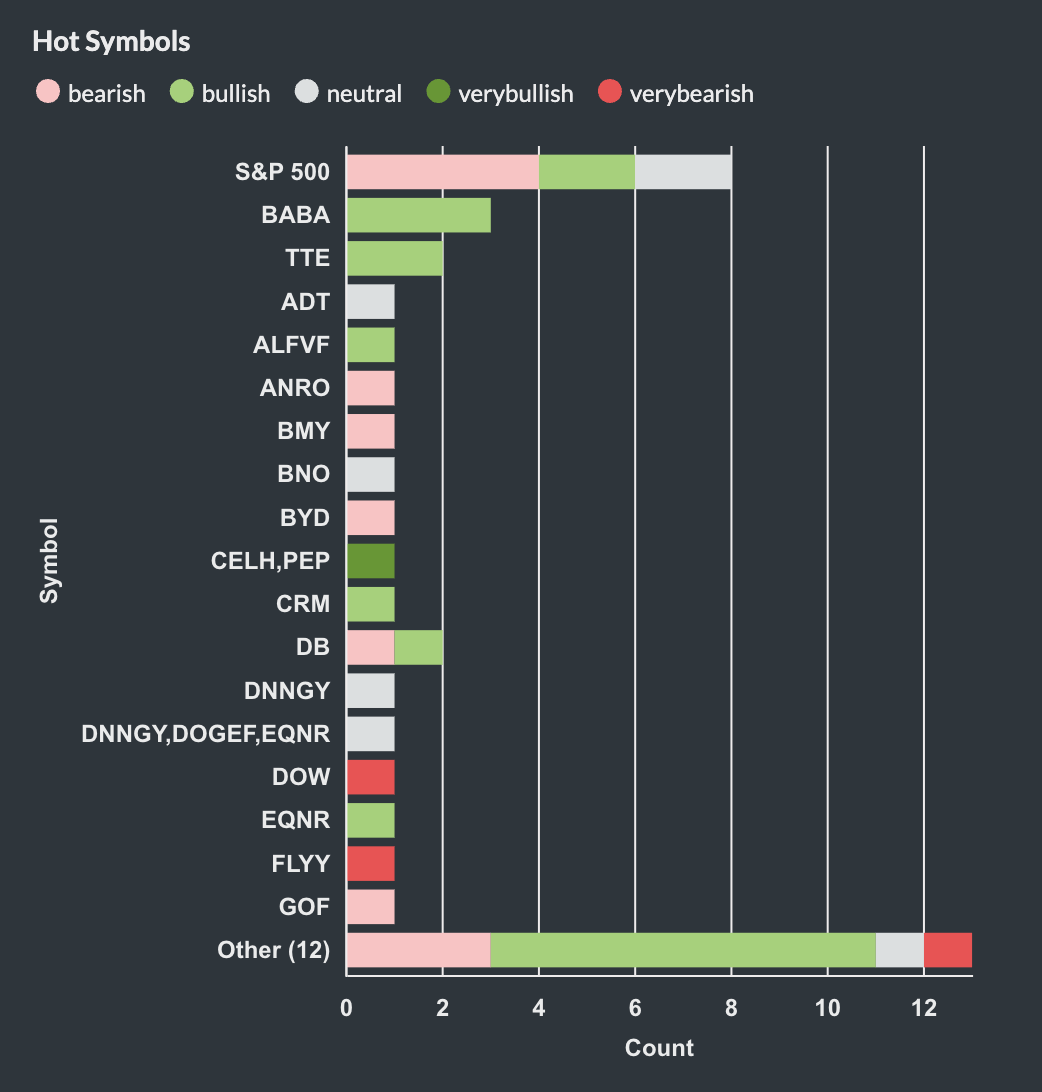

Bearish dominance highlights political and monetary risks (e.g., Trump–Fed conflict, tariffs, etc.).

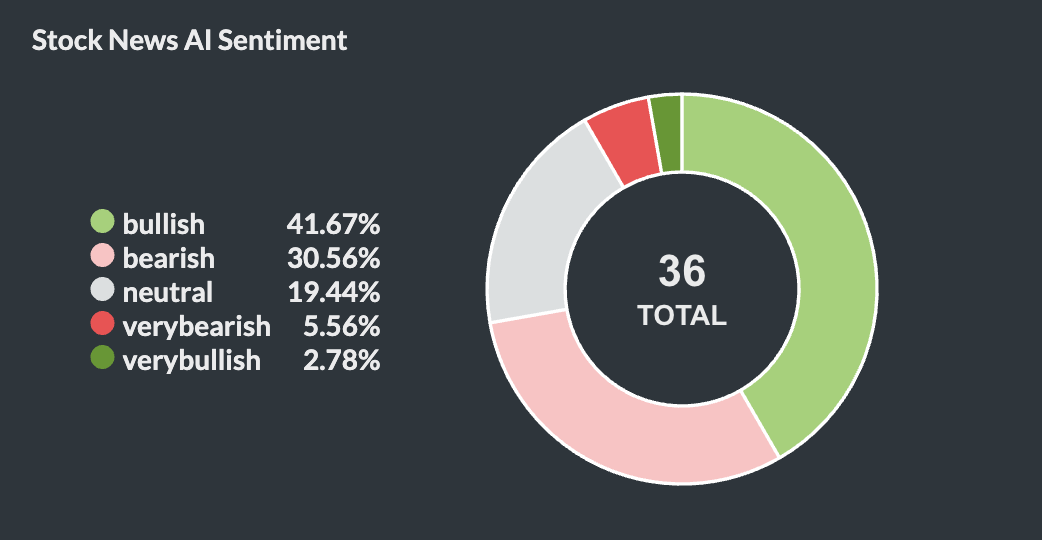

However, optimism arise around company-level growth (e.g., BABA, TTE, PEP) despite macro headwinds.

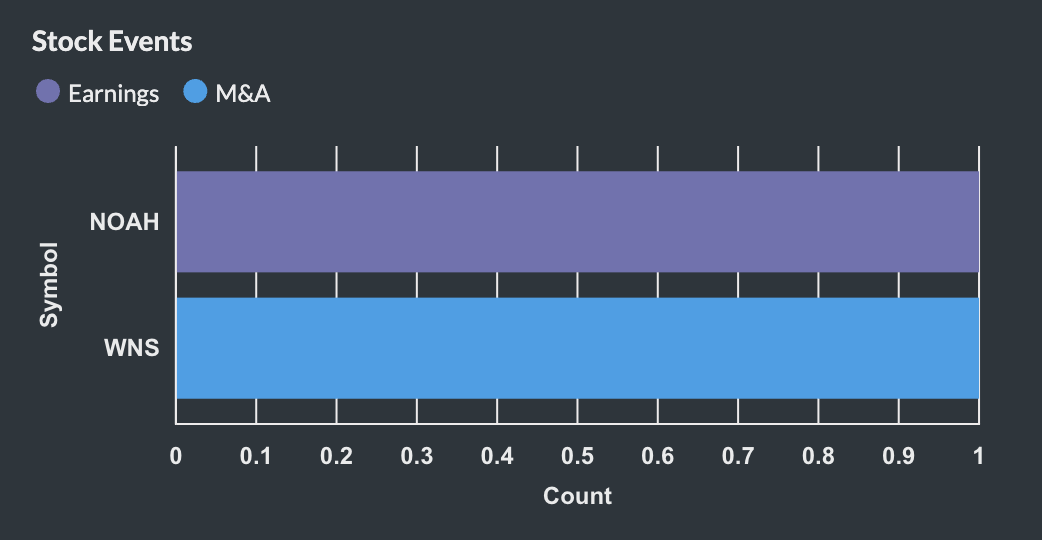

Here’s a breakdown of key stock events by our AI Event signal for today, 9/1.

The Must-Know News Stories for Today, 9/1.

Our AI cuts through the noise, saving you 16 minutes by delivering the heart of today’s events in seconds!

The Guardian

BearishShortTermS&P 500Economic

Trump's war on Fed is ‘serious danger' to world economy, says ECB head

- Christine Lagarde warns Trump's influence on the Fed could harm global economy.

- Trump's attempt to remove Fed officials threatens U.S. monetary policy independence.

- Political interference could compromise central banks' ability to control inflation.

- Rising U.S. government borrowing costs raise concerns over Trump's tariff policies.

- Lagarde believes it's hard for Trump to control Fed decision-making.

CNBC

BullishLongTermNEEIndustry News

An Iowa nuclear plant is the next contender to restart, spurred by AI data center demand

- Duane Arnold nuclear plant plans to restart by 2028 after economic shutdown.

- FERC has approved reconnection to the electric grid for the plant.

- NextEra aims for power purchase agreements to support Duane Arnold's operations.

- The restart is high-capital intensive, potentially costing $100 million in 2025.

- Nuclear restarts show industry recovery amid demand growth from data centers.

Forbes

BullishLongTermBABACorporate Developments

Alibaba Shares Soar 18.5% On Strong AI And E-Commerce Outlook

- Alibaba shares surged 18.5% in Hong Kong driven by AI growth.

- Cloud revenue rose 26% to 33.4 billion yuan, exceeding expectations.

- Net income up 76% to 42.4 billion yuan, aided by equity changes.

- Taobao app's active users grew 25% year-on-year, enhancing revenue prospects.

- Profitability dip due to subsidies amidst fierce food delivery competition.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply