US markets dipped after a credit downgrade; Regeneron announced a $256M acquisition of bankrupt 23andMe; Walmart responded to tariff tensions amid mixed earnings.

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

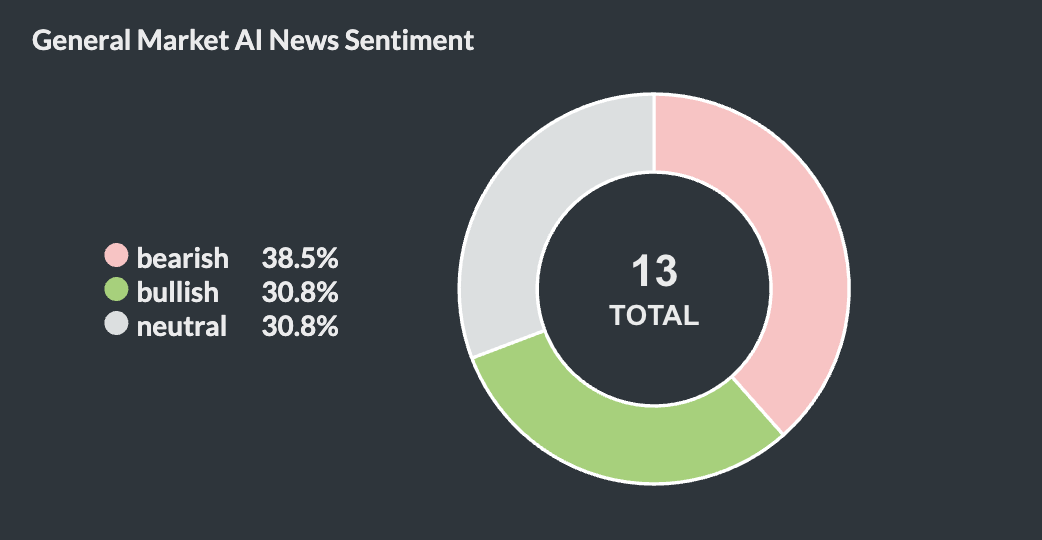

Overall, our AI leans to a BEARISH stance on general market news.

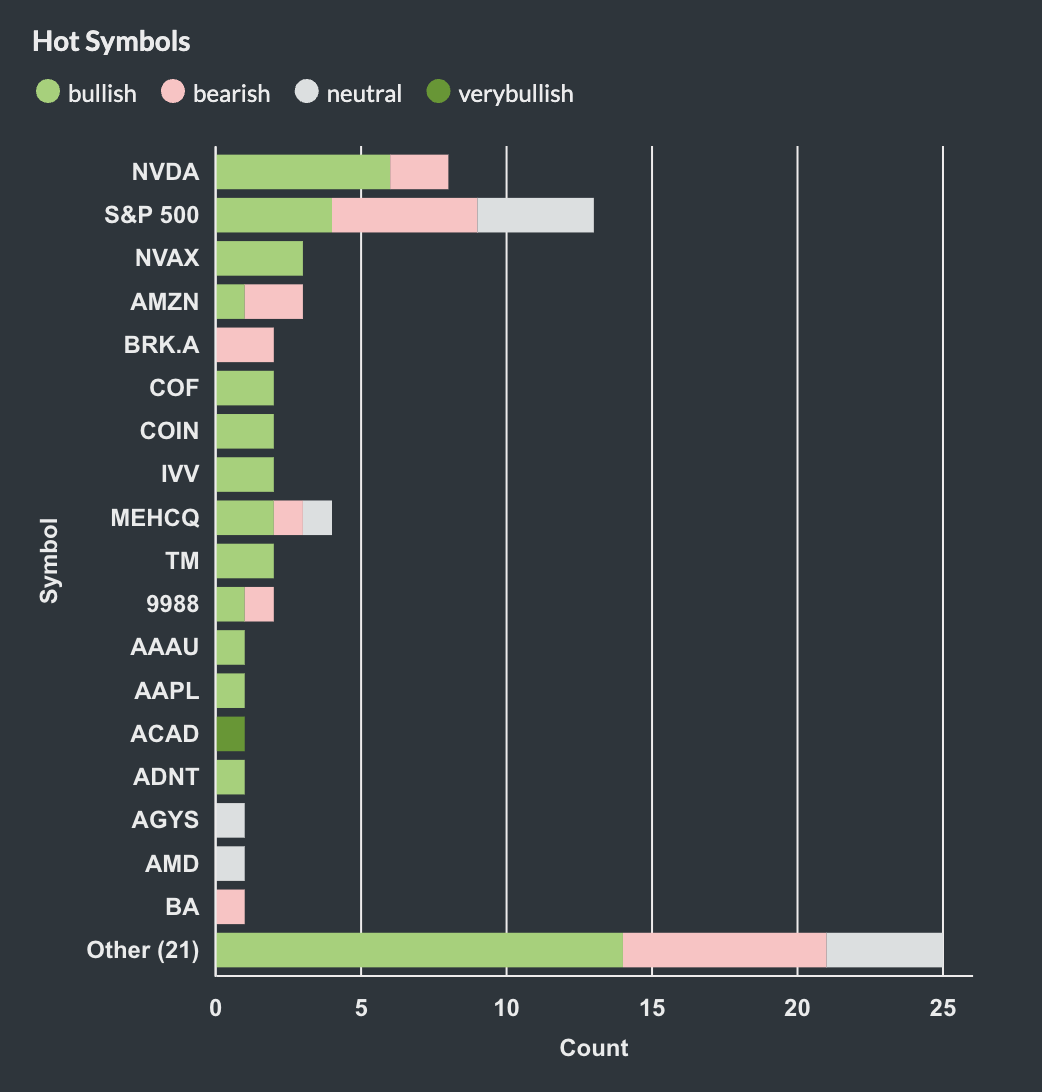

Despite an overall bearish market trend, some individual stocks are still detected with bullish movement by our AI.

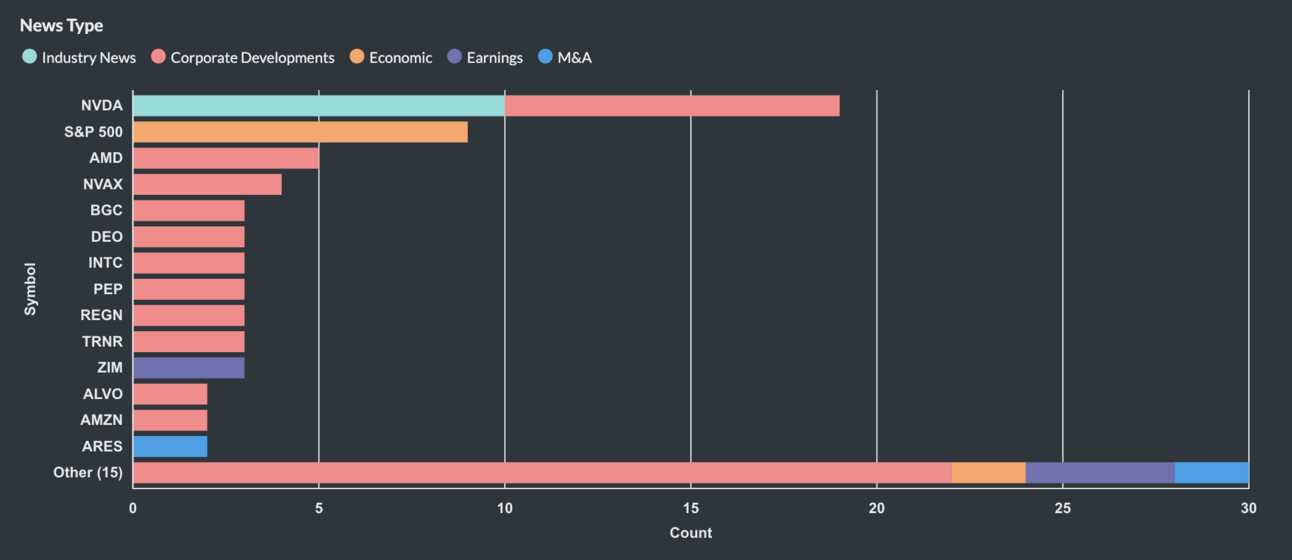

Here’s a breakdown of key stock events by our AI Event signal for today, 5/19.

The Must-Know News Stories for Today, 5/19.

Our AI cuts through the noise, saving you 12 minutes by delivering the heart of today’s events in seconds!

New York Post

BearishShortTermS&P 500Economic

US stocks fall on US downgrade — after 2-day streak in the green

- Moody's downgraded US credit rating from Aaa to Aa1, spooking markets.

- S&P 500 fell 0.3% in response to the downgrade.

- Higher Treasury yields reached levels last seen in November 2023.

- Dow's slight decline breaks a short-lived two-day green streak.

- Budget deficit costs and high interest rates prompted Moody's action.

CNBC

BullishLongTermMEHCQM&A

Regeneron Pharmaceuticals to buy 23andMe and its data for $256 million

- Regeneron to acquire 23andMe assets for $256 million amid bankruptcy.

- 23andMe faced challenges generating revenue, leading to its Chapter 11 filing.

- Regeneron aims to enhance 23andMe's DNA service and health initiatives.

- Privacy concerns over genetic data still loom, impacting the acquisition review.

- The deal requires bankruptcy court approval, expected by third quarter 2025.

Market Watch

BearishShortTermWMTIndustry News

After Trump rages, Walmart says it will eat ‘some’ of the tariff costs - MarketWatch

- Walmart plans to absorb some tariff impacts on prices.

- Trump criticized Walmart for blaming tariffs for price increases.

- Walmart's net income rose, but slightly missed analyst expectations.

- Tariff impact on pricing to be closely monitored by investors.

- Retail earnings season may reveal broader pricing trends.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply