Market Volatility Surges Amid Tariff Turmoil; Apple and Oil Slide on Recession Fears

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

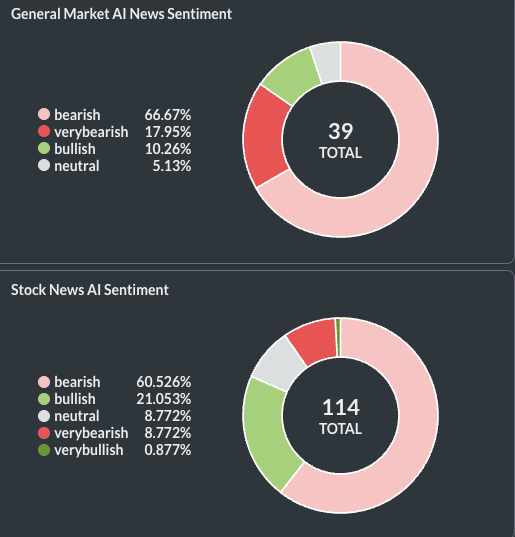

Overall, our AI signals a BEARISH stance on general market news, aligning with major bearish events. The trend has continued since mid-March.

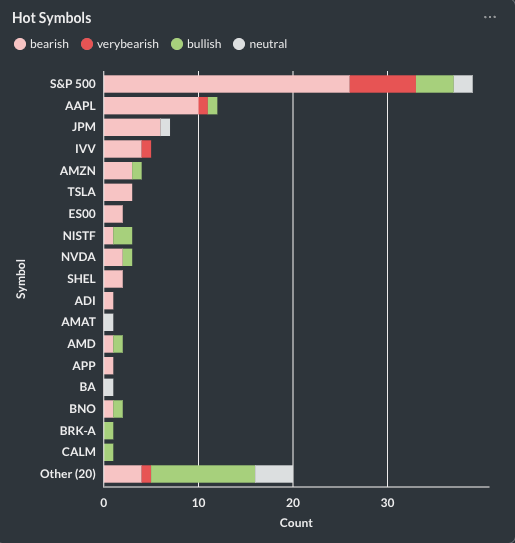

Today’s market volatility reflects both the broader bearish trend and individual stock performance.

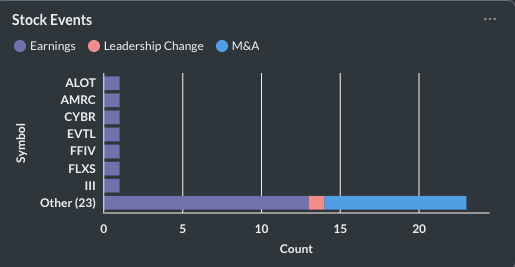

Here’s a breakdown of key stock events by our AI Event signal for today, 4/7.

The Must-Know News Stories for Today, 4/7.

Our AI cuts through the noise, saving you 11 minutes by delivering the heart of today’s events in seconds!

NYTimes

BearishShortTermS&P 500Industry News

U.S. Markets Swing Wildly as Trump Admin Denies 90-Day Tariff Pause Report

- Markets reacted sharply over unverified tariffs report from President Trump.

- Trump's administration dismissed the report as 'fake news'.

- S&P 500 briefly dipped into bear market territory amid tariff threats.

- Trump indicated he would negotiate tariffs, raising potential market volatility.

- President called for Fed to cut interest rates, raising inflation concerns.

Benzinga

VeryBearishShortTermAAPLMarket Recap

Apple Stock's Death Cross: Is The iPhone Maker Heading For A Rotten Summer?

- AAPL stock has dropped 22.75% year-to-date, raising concerns.

- Technical indicators show Apple facing strong selling pressure.

- Analyst cuts price target from $325 to $250 amid tariff fears.

- Apple's reliance on Chinese manufacturing heightens tariff impacts.

- Overall market sentiment towards AAPL is currently bearish.

benzinga.com

BearishShortTermXOMIndustry News

Oil Crashes To $60 Per Barrel As Global Recession Fears Grow - Exxon Mobil (NYSE:XOM)

- WTI crude oil hit a two-year low near $60 per barrel.

- Goldman Sachs raised recession probability to 45%, impacting oil demand outlook.

- OPEC+ increased production, adding downward pressure on oil prices.

- Exxon Mobil's break-even point is at $65 per barrel, now exceeded.

- Energy Secretary claims U.S. shale can produce even at $50 per barrel.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply