Stocks and dollar slide together, tariffs boost bank trading, and hotel stocks downgraded on weaker outlook.

Happy Monday, everyone! 🎉 I’m excited to share that our team has upgraded the Analytics Dashboard! The enhanced dashboard now provides a powerful high-level view of market trends and key AI events, helping you stay ahead of the game. Check it out if you haven’t already!

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

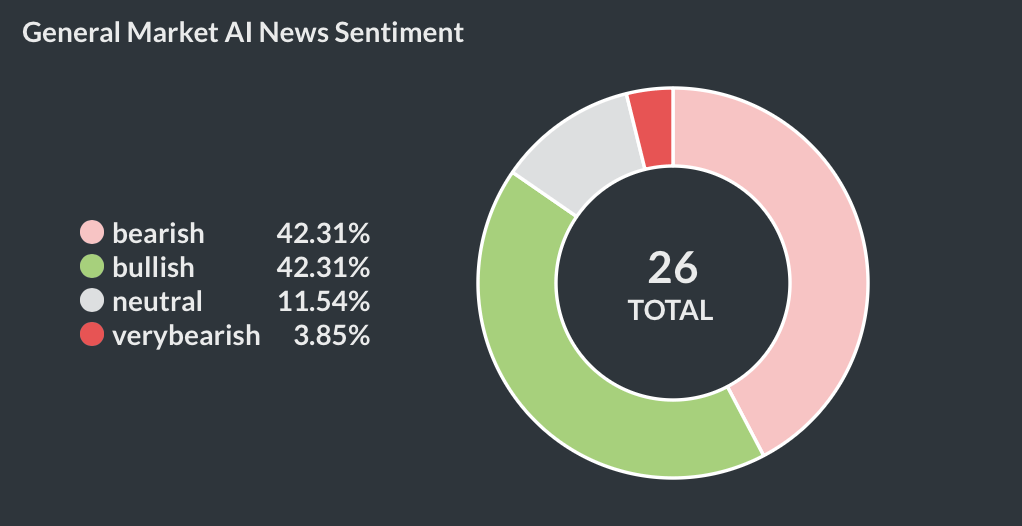

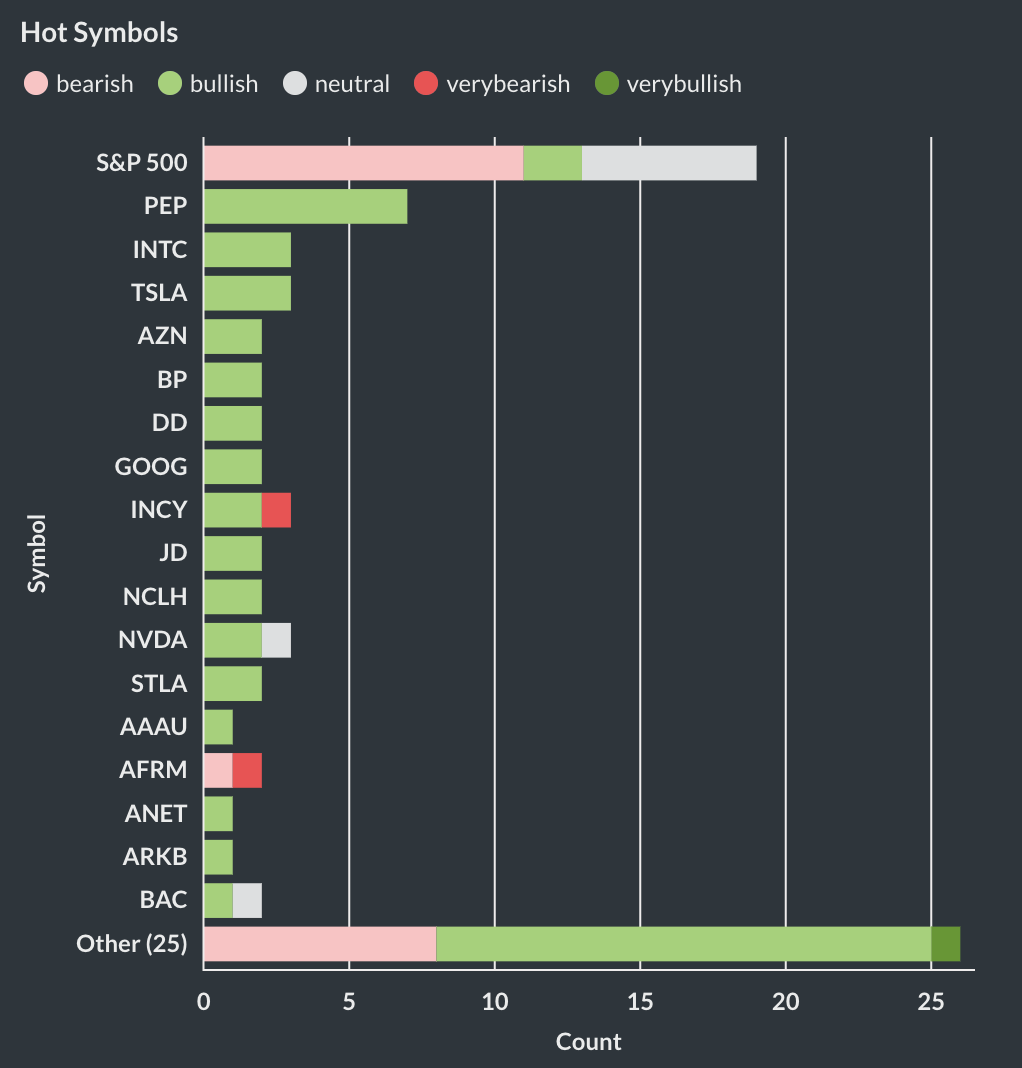

Overall, our AI indicates a BEARISH stance on general market news, and the bearish trend has continued since mid-March.

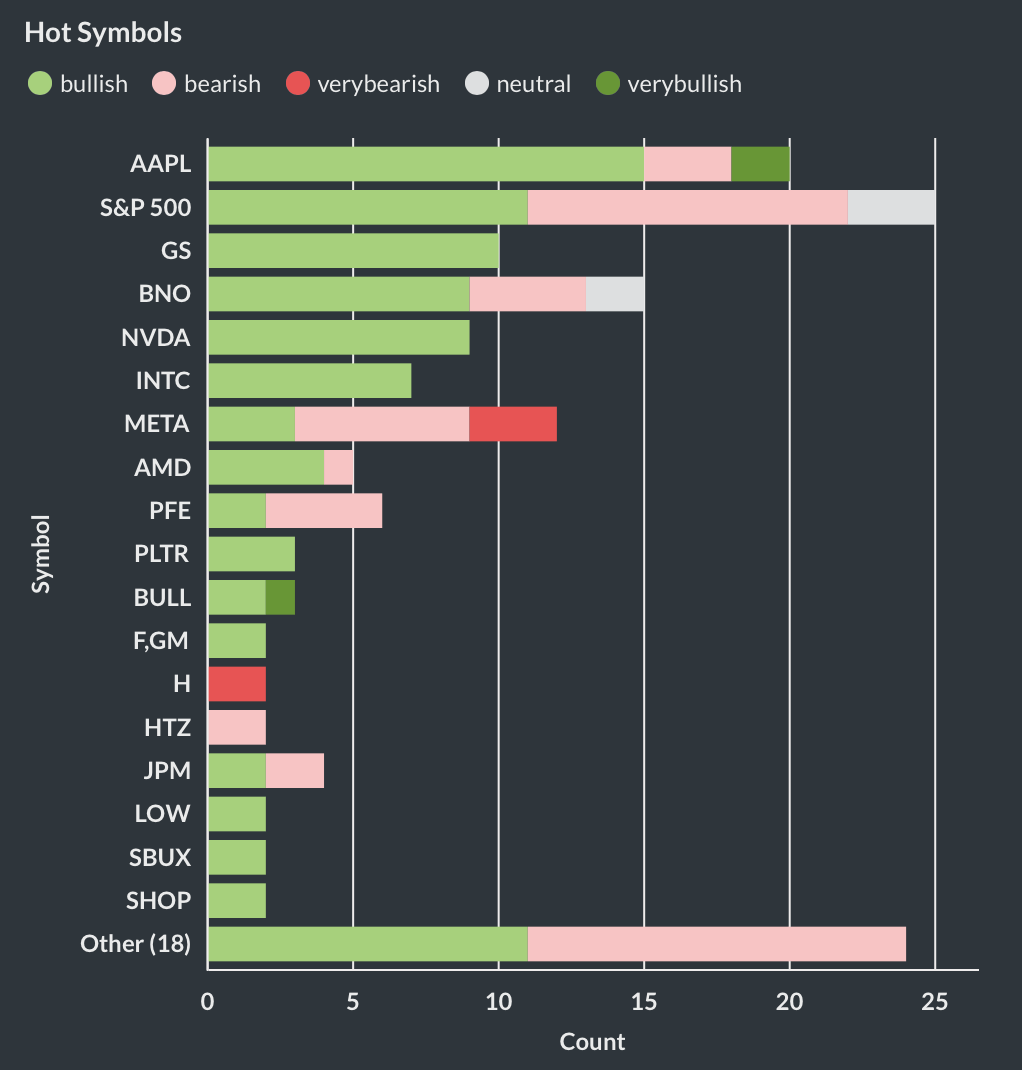

Despite an overall bearish market trend, some individual stocks are still detected with bullish movement by our AI.

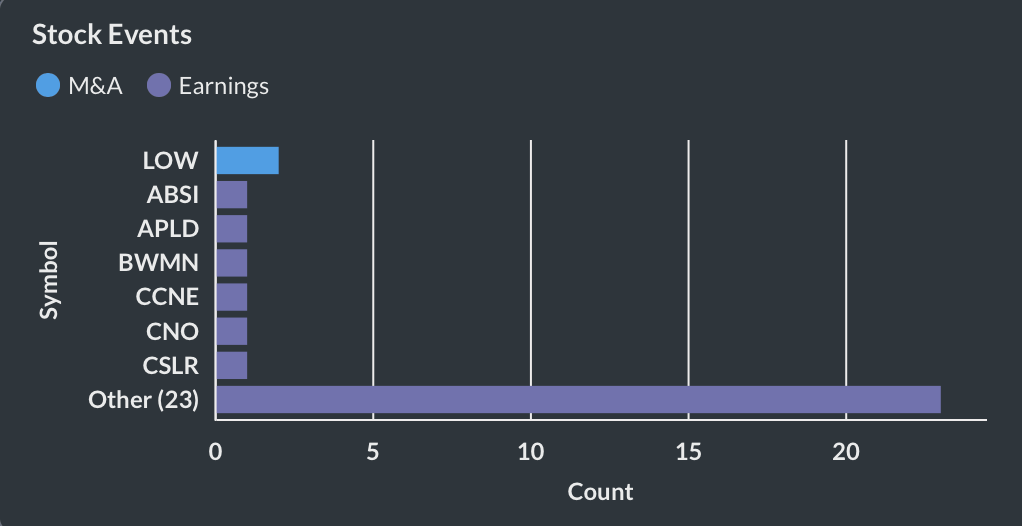

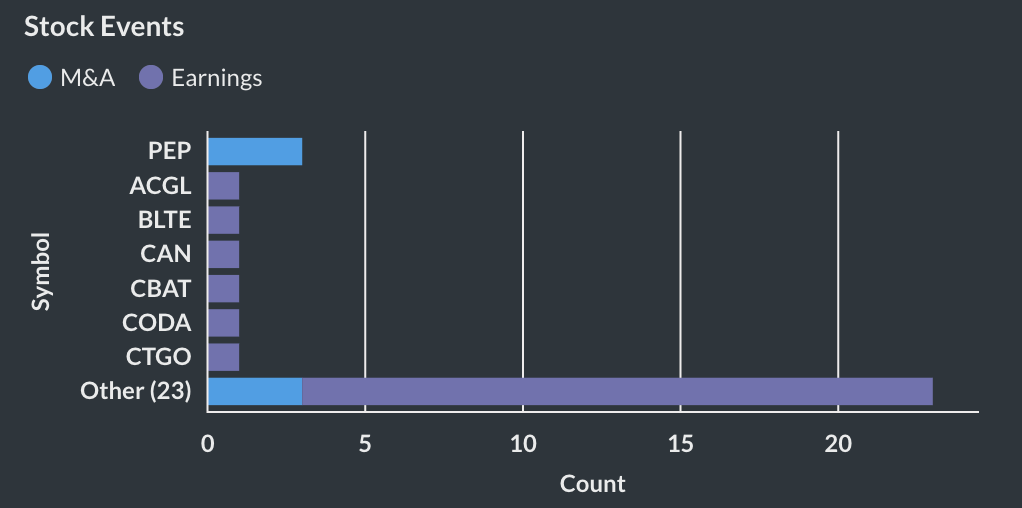

Here’s a breakdown of key stock events by our AI Event signal for today, 4/14.

The Must-Know News Stories for Today, 4/14.

Our AI cuts through the noise, saving you 14 minutes by delivering the heart of today’s events in seconds!

Market Watch

BearishShortTermS&P 500Market Recap

It’s rare for stocks and the dollar to fall together. History says tread carefully. - MarketWatch

- S&P 500 and U.S. dollar decline together, a rare occurrence.

- Foreign investors may be avoiding U.S. assets due to tariffs.

- Historical patterns show potential for lower S&P 500 lows.

- S&P 500 usually rallies slightly after similar declines.

- Caution is advised; favorable entry points should be sought.

WSJ

BullishShortTermGSIndustry News

Trump’s Tariff Chaos Fuels Q1 Trading Revenue for Goldman, JPMorgan - WSJ

- Goldman Sachs reported record equities revenue growth of 27%.

- Increased trading activity stemmed from investor reactions to tariff uncertainties.

- CEO David Solomon noted a strong performance despite market volatility.

- Equity derivatives trading surged, indicating investor anticipation of volatility.

- Goldman's deal backlog is improving, hinting at future opportunities.

Investopedia

VeryBearishShortTermHIndustry News

Hyatt, Hilton, and Marriott Stocks Downgraded by Goldman Sachs on Weaker Hotel Outlook

- Goldman Sachs downgraded Hyatt to 'sell' amid economic uncertainty.

- U.S. hotels' RevPAR growth forecast reduced to 0.4% for 2025.

- Economic outlook could worsen without accounting for recession risks.

- Airlines report weakening travel demand, affecting hotel stocks.

- Hyatt shares fell 3% following the downgrade announcement.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Bearish Market Trend Persists Amid Tariff Uncertainty; PepsiCo's Prebiotic Soda Bet Signals Bullish Potential

Happy Monday, everyone! 🎉 I’m excited to share that our team has upgraded the Analytics Dashboard! The enhanced dashboard now provides a powerful high-level view of market trends and key AI events, helping you stay ahead of the game. Check it out if you haven’t already!

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

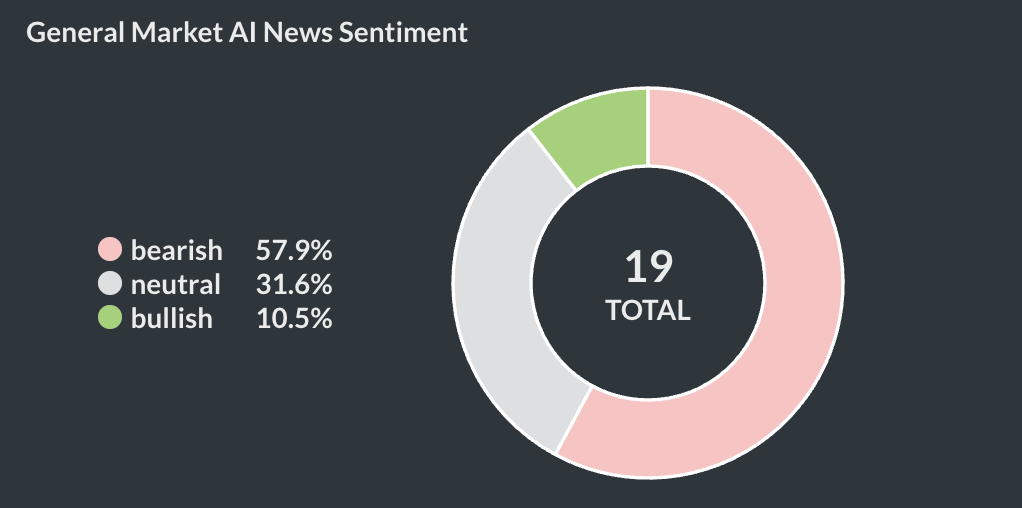

Overall, our AI indicates a BEARISH stance on general market news.

Despite an overall bearish market trend, some individual stocks are still detected with bullish movement by our AI.

Here’s a breakdown of key stock events by our AI Event signal for today, 3/17.

The Must-Know News Stories for Today, 3/17.

Our AI cuts through the noise, saving you 8 minutes by delivering the heart of today’s events in seconds!

CNBC

BearishShortTermS&P 500Economics

Trump economic advisor Kevin Hassett warns of more uncertainty over tariffs

- Trump's aides predict economic uncertainty until April 2.

- Confusion over tariffs causes market volatility, delaying investments.

- Business leaders highlight ongoing risks related to tariff policies.

- Consumers may lose confidence as tariff announcements persist.

- Recession concerns remain amid tariff-related market instability.

CNBC

BullishLongTermPEPM&A

PepsiCo buys prebiotic soda brand Poppi for more than $1.6 billion

- PepsiCo acquires Poppi for $1.95 billion, targeting prebiotic soda market.

- Poppi's sales exceeded $100 million in 2023, reflecting strong market demand.

- Regulatory approval is pending for Pepsi's acquisition of the health-focused brand.

- Poppi settled a health claims lawsuit for $8.9 million, impacting its reputation.

- Rival Olipop is valued at $1.85 billion, signaling strong competition.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Bearish Market Trend Persists Amid Tariff Uncertainty; PepsiCo's Prebiotic Soda Bet Signals Bullish Potential

Happy Monday, everyone! 🎉 I’m excited to share that our team has upgraded the Analytics Dashboard! The enhanced dashboard now provides a powerful high-level view of market trends and key AI events, helping you stay ahead of the game. Check it out if you haven’t already!

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

Overall, our AI indicates a BEARISH stance on general market news.

Despite an overall bearish market trend, some individual stocks are still detected with bullish movement by our AI.

Here’s a breakdown of key stock events by our AI Event signal for today, 3/17.

The Must-Know News Stories for Today, 3/17.

Our AI cuts through the noise, saving you 8 minutes by delivering the heart of today’s events in seconds!

CNBC

BearishShortTermS&P 500Economics

Trump economic advisor Kevin Hassett warns of more uncertainty over tariffs

- Trump's aides predict economic uncertainty until April 2.

- Confusion over tariffs causes market volatility, delaying investments.

- Business leaders highlight ongoing risks related to tariff policies.

- Consumers may lose confidence as tariff announcements persist.

- Recession concerns remain amid tariff-related market instability.

CNBC

BullishLongTermPEPM&A

PepsiCo buys prebiotic soda brand Poppi for more than $1.6 billion

- PepsiCo acquires Poppi for $1.95 billion, targeting prebiotic soda market.

- Poppi's sales exceeded $100 million in 2023, reflecting strong market demand.

- Regulatory approval is pending for Pepsi's acquisition of the health-focused brand.

- Poppi settled a health claims lawsuit for $8.9 million, impacting its reputation.

- Rival Olipop is valued at $1.85 billion, signaling strong competition.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Bearish Market Trend Persists Amid Tariff Uncertainty; PepsiCo's Prebiotic Soda Bet Signals Bullish Potential

Happy Monday, everyone! 🎉 I’m excited to share that our team has upgraded the Analytics Dashboard! The enhanced dashboard now provides a powerful high-level view of market trends and key AI events, helping you stay ahead of the game. Check it out if you haven’t already!

Remember to move the mail to the Primary inbox if this mail is in other inboxes.

Overall, our AI indicates a BEARISH stance on general market news.

Despite an overall bearish market trend, some individual stocks are still detected with bullish movement by our AI.

Here’s a breakdown of key stock events by our AI Event signal for today, 3/17.

The Must-Know News Stories for Today, 3/17.

Our AI cuts through the noise, saving you 8 minutes by delivering the heart of today’s events in seconds!

CNBC

BearishShortTermS&P 500Economics

Trump economic advisor Kevin Hassett warns of more uncertainty over tariffs

- Trump's aides predict economic uncertainty until April 2.

- Confusion over tariffs causes market volatility, delaying investments.

- Business leaders highlight ongoing risks related to tariff policies.

- Consumers may lose confidence as tariff announcements persist.

- Recession concerns remain amid tariff-related market instability.

CNBC

BullishLongTermPEPM&A

PepsiCo buys prebiotic soda brand Poppi for more than $1.6 billion

- PepsiCo acquires Poppi for $1.95 billion, targeting prebiotic soda market.

- Poppi's sales exceeded $100 million in 2023, reflecting strong market demand.

- Regulatory approval is pending for Pepsi's acquisition of the health-focused brand.

- Poppi settled a health claims lawsuit for $8.9 million, impacting its reputation.

- Rival Olipop is valued at $1.85 billion, signaling strong competition.

Like StockNews.AI? Unlock more functions by joining our Premium or Pro Plan 🏠 🙌

Disclaimer: The content provided in this Email should be used for informational purposes only and in no way should be relied upon for financial advice.

Reply